The cheque imaging process is quicker than the traditional system. Cheques deposited before 10pm on a working day will be available by 11:59pm the next working day, provided the cheque has not bounced. You can see when money is added to your account by using the HSBC UK Mobile Banking app. Chase Bank is one of the big banks that does allow you to cash a check. How to Cash a Third Party Check Online Instantly. Most of the ways that involve instant online check cashing involve the use of your phone. Cashing a third party check instantly now involves using a smartphone. This saves a tremendous amount of time cashing a check online versus going to a.

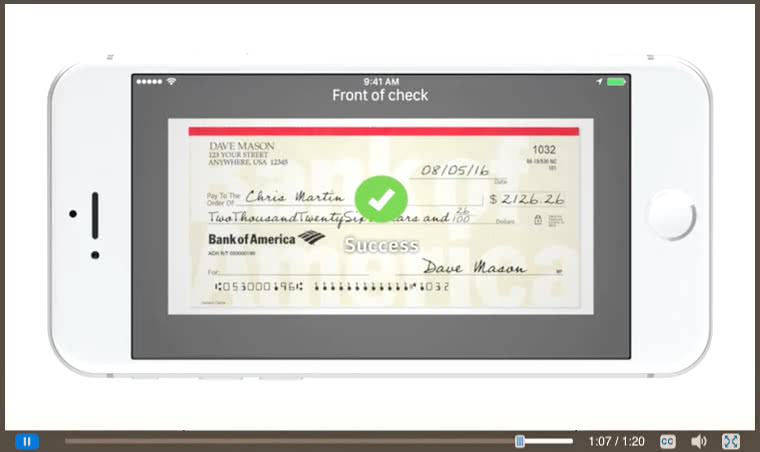

Cash a Check service in the PayPal app allows you to cash checks and have them credited to your PayPal Cash Plus account, using the PayPal app on your mobile device. You simply take a picture of the check you want to cash, and send it to us for review. If your check is approved, you have the option to pay a fee and get your money credited to. Paying in cheques and cash Cheques. Send your cheques by post. You’ll need to visit us in branch to pay in cash. Any amount can be paid in at the counter. Find your nearest branch. Getting cash out. If you need to withdraw cash, you can do this without coming in to branch.

© Joe Raedle/Getty Images 4 Ways to cash a check without a checking accountIf you have a checking or savings account at a federally insured bank, you should have no trouble cashing a check there.

But for the millions of people without a bank account, check cashing is not as easy. Approximately 8.4 million U.S. households, comprising 14.1 million adults, don’t have a bank account, according to a 2017 survey from the Federal Deposit Insurance Corporation.

There are ways to cash a check without a bank account, but they cost more money, often require more time and involve more risk than check cashing at a bank where you have an account. Here are five options:

1. Check cashing at the issuing bank

Banks and credit unions are not required to cash checks for non-customers, but many banks will cash a check payable to a non-customer if the check is written by an account holder at that bank.

There are a few requirements though. For one, there must be enough money in the account the check is written against to cover the check. The payee will need to show identification, such as a driver’s license or military ID.

The payee also should expect to pay a fee. Check-cashing fees at traditional banks hover around $8. If you get paid 52 weeks a year, that’s $416 in check-cashing charges.

And there may be restrictions, such as limits on check amounts and refusal of two-party personal checks. Checks that are six months old or more might be declined.

2. Check cashing at a retailer

There are a number of big retail stores like Kmart, Walmart and grocery chains that offer check-cashing services.

The least expensive option is probably Kmart, if you can find one that hasn’t closed. The struggling retailer charges only $1 or less to cash checks, including two-party personal checks up to $500. The caveat is that you need to be a member of the store's 'Shop Your Way' program to use the service. Joining the program is free.

Walmart charges $4 to cash checks up to $1,000 and up to $8 for checks more than that amount. Walmart also cashes two-party personal checks, but it limits them to $200 and charges a $6 max fee.

Grocery chains often provide check-cashing services. Kroger, Publix, Giant Eagle, Albertsons and Ingles, to name a few, cash checks. Fees typically range from about $3 to $6.

3. Loading funds onto a prepaid debit card

Video: 5 Things To Downsize Before You Retire (GOBankingRates)

People who don't have bank accounts sometimes use prepaid cards to deposit checks and access their cash. Prepaid cards are similar to checking account debit cards. Your spending is limited by how much money you have loaded onto the card.

Prepaid cards have different options for check cashing. Some prepaid cards let you set up direct deposit so that checks are automatically loaded onto the card. Other cards come with an app that lets you snap a picture of your check to load it onto your card. Or, you might be able to deposit your check at an ATM to load the money onto the card.

Fees are a big drawback of prepaid cards. The Walmart MoneyCard charges $2.50 to withdraw money at an ATM (not including the fee the bank charges) or a bank teller window, and 50 cents to check your card balance at an ATM. There is a monthly fee of $5.94 unless you load $1,000 a month onto the card.

Reload fees can be steep. It can cost you up to $5.95 to add money to a Green Dot Prepaid Visa card. Green Dot also charges a $3 ATM fee. Sometimes, prepaid card fees are scaled according to how quickly you want your money, and you can get dinged for expedited availability.

4. Cashing your check at a check-cashing outlet

Check-cashing outlets are probably the most expensive places to cash checks. Some of them require customers to become “members” or to buy check-cashing ID cards before they will cash your checks. In addition to a membership fee, they might charge a first-time use fee.

Fees to cash a check can range from 1 percent to 12 percent of the face value of the check. That means you could pay from $10 to $120 to cash a $1,000 check. Some businesses charge a flat fee on top of the percentage.

The average face value of a check presented to a check-cashing outlet is $442.30, with the average fee to cash that check being $13.77, or about 3.1 percent, according to the FDIC. If that’s your paycheck and you cash it every week, you’ll pay $55.08 a month, or $661 a year, in check-cashing fees

Not only are check-cashing stores exorbitantly expensive, there is a risk of deceptive practices. The Better Business Bureau, for example, alerts consumers to a scam whereby customers of a check-cashing store are called by someone who claims to represent the business. The caller offers the customer a loan and requests payment to secure the loan. Of course, the loan is never received and the customer of the check-cashing store gets scammed out of some cash.

Check-cashing stores should be your last resort.

5. Sign your check over to someone you trust

Another way to cash a check if you don’t have a bank account is to sign the check over to someone you trust who does have a bank account and have that person cash the check at their bank.

Make sure the person you want to sign it over to is willing to cash the check, and that his or her bank will cash it. You should accompany your trusted friend to the bank in case the teller requires your ID or has questions about the check.

The person must have the proper identification and be prepared to have his or her check dinged by a check-cashing fee. There is also a personal and financial safety risk. Paper checks and cash can be lost or stolen.

Bottom line

Turning that paper check into cash in your hands is trickier if you don’t have a bank account. Unlike the consumer who has a bank account and direct deposit of their income, unbanked consumers almost have to plan ahead to cash their checks and access their money.

It’s fairly easy to find a bank or other business that will cash your check if you don’t have a bank account. But there will be fees and restrictions. And there are risks associated with carrying checks and cash.

The best way to cash checks is by opening a checking or savings account at a federally insured bank or credit union, then setting up direct deposit of your payroll check, tax refund, pension benefit and other income. Not only is it safer and easier, it will cost you less.

Related Articles

1PayPal Cash a Check Campaign Terms and Conditions

Cash Cheque Online

How it works. For a limited time, use PayPal’s Cash a Check feature in our mobile app to cash any government-issued stimulus check, government-issued check or payroll check with a pre-printed signature and the check cashing fee of 1% for disbursement in minutes will be waived for approved checks (“Offer”). Checks which are not approved will not be transferred to your account with PayPal. PayPal reserves the right to cancel, extend, suspend or modify this Offer in part or in its entirety at any time without notice, for any reason in its sole discretion. Any questions relating to the promotion will be resolved in PayPal’s sole discretion and its decisions are final and binding.

Offer Period. Offer ends when the $400,000 USD cap has been reached. (“Offer Period”).

Eligibility Requirements. Must have a U.S. PayPal Cash Plus account (“Valid Account”) in good standing to participate. Must use your Valid Account and the Cash-a-Check feature in the PayPal mobile app to a) take a picture of any government issued stimulus check, government issued check or payroll check with a pre-printed signature that you want to cash, and b) send through the PayPal app for review. If approved, the check funds will be transferred into your PayPal Cash Plus account. Offer is limited to a maximum check transfer amount of $5,000 USD per day for each PayPal Cash Plus account holder. There is a minimum allowed per check transfer of $5.00 USD. The total maximum check transfer per PayPal Cash Plus account in 30 days is $15,000 USD. For the best experience, use the latest versions of the PayPal app and operating system on your mobile device.

Exclusions/Disqualification. Offer is void and 1% check cashing fee will not be waived if, in PayPal’s sole discretion: (1) it is made in an attempt to tamper with or impair the administration, security, proper play, or fairness of this Offer, (2) it is not completed through legitimate channels, (3) any Offer-related materials are counterfeit, altered, defective, tampered with or irregular in any way, or (4) any person supplies false or misleading information, participates by any fraudulent means, or is otherwise determined to be in violation of these Terms. The Offer is void where prohibited, if submissions are not completed through legitimate channels, or if any promotion related materials are counterfeit, altered, fraudulent, defective, tampered with or irregular in any way.

Cash Cheques Instantly

The Cash a Check feature is a service provided by First Century Bank, N.A. and Ingo Money, Inc., subject to the First Century Bank and Ingo Money Terms and Conditions and Privacy Policy. Fees and terms apply. All checks subject to review for approval. Unapproved checks will not be funded to your account. For more details, visit www.ingomoney.com/partners/paypal-terms-conditions.

2The PayPal Cash Card is a debit card linked to your PayPal Cash Plus balance. The PayPal Cash Card is not a credit card. PayPal is not a bank and does not itself take deposits. You will not receive any interest on the funds in your PayPal Cash Plus account. Funds you hold in a PayPal Cash Plus account are not insured by the FDIC unless you have successfully requested a PayPal Cash Card. If you have successfully requested a PayPal Cash Card, then we will deposit the funds in your PayPal Cash Plus account into a pooled deposit account held by us for your benefit at an FDIC-insured bank. This structure used for accounts with a PayPal Cash Card is intended to provide the funds in your PayPal Cash Plus account with the benefit of pass-through FDIC insurance up to applicable limits.

Cash Check Online Fast

The PayPal Cash Mastercard is issued by The Bancorp Bank pursuant to a license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Card may be used everywhere Mastercard is accepted. The Bancorp Bank is issuer of the Card only and not responsible for the associated accounts or other products, services, or offers from PayPal.

Cash Cheque Online Rbs

3PayPal Cash Plus account required to get the card.

Approval contingent on ID verification. IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW CARD ACCOUNT: To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens a Card Account. What this means for you: When you open a Card Account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see a copy of your driver’s license or other identifying documents. Terms apply. See Cardholder Agreement for details.